How to Become a Time Billionaire

There are no public markets for time. No ETFs, no futures contracts, no commodity indexes. But it may be the most mispriced asset in the modern economy.

We routinely speak of "spending time" and "saving time" and "wasting time," but the metaphor collapses under scrutiny. Time doesn’t accumulate. It doesn’t regenerate. You can't lend it out and get interest. You can only spend it or not.

Yet somewhere between productivity gurus and burnout culture, we started treating time as something other people owned. The manager schedules your hours. The client dictates your deadlines. The algorithm nudges your attention. Every modern institution is, in some way, a time exchange - buying yours cheaply, renting it out more expensively, and extracting the spread. If you don't believe that, consider this: the richest man in the world once slept on his factory floor because he thought his investors needed the appearance, the theatre that they were capturing more of his hours.

It’s a strange thing to be time-rich and unaware of it. Stranger still to give it away voluntarily. Most people, even highly-paid professionals, operate like time paupers. They earn six figures, but they’re always out of hours. They speak wistfully of sabbaticals, slow mornings, creative focus blocks. They call it "time freedom" as if it's a lottery prize.

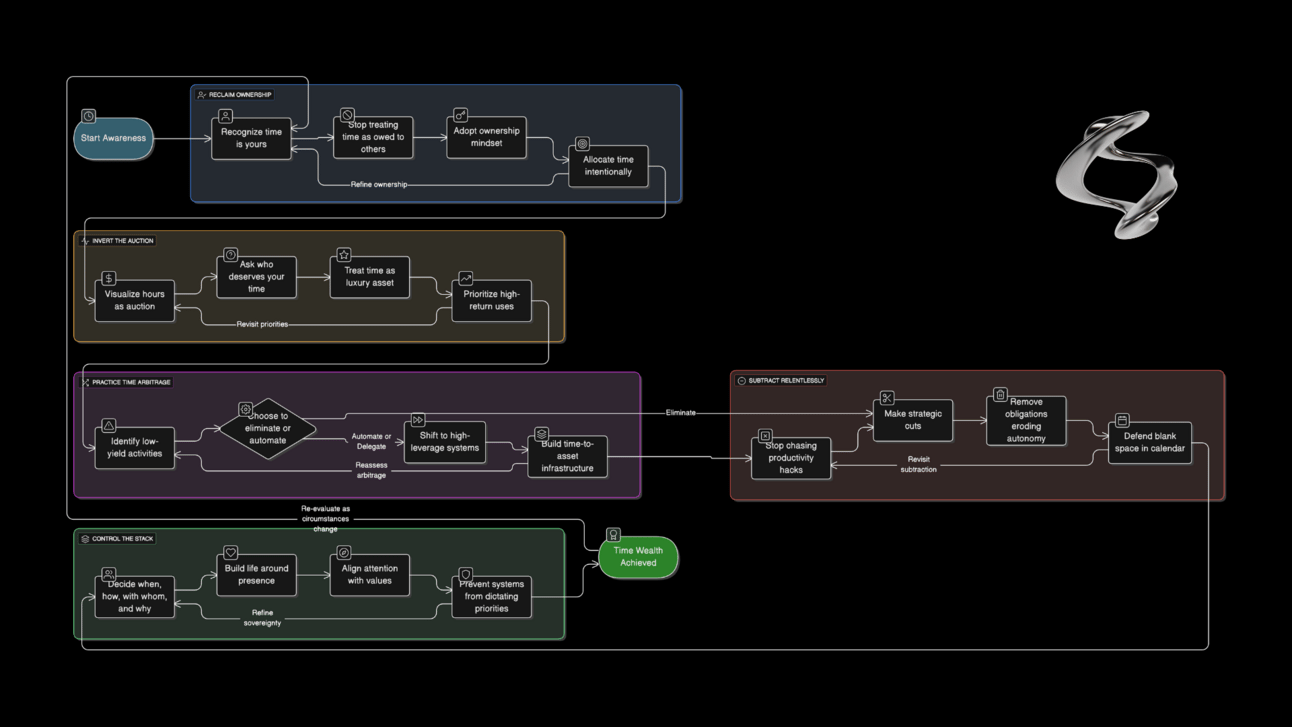

This is a manifesto for the opposite. Not the desperate clawback of lost hours; the strategic refusal to give them away. Not productivity as extraction; time as ownership.

Becoming a time billionaire starts with a single premise: your hours are already yours.

You just forgot who owns the account.

The Hour Auction

Let’s play an economic game. Imagine every hour of your day is up for auction. Each bidder wants a piece of you: clients, colleagues, feeds, notifications, content, meetings, favors, tasks, the infinite scroll of mild obligations. Who wins?

Usually, it’s the bidder who offers the most urgent fiction. A Slack ping pretends to be an emergency. A calendar invite masquerades as significance. A trending topic insists it’s vital you read it. Each steals a bit of cognition, a bit of agency, a bit of the time you thought was yours.

But what would happen if you reversed the auction? If you had to bid for your own time every morning, using actual money, what would you pay for an uninterrupted hour of thinking? $50? $500? $5,000?

You start to notice the absurdity: the average knowledge worker would kill for a single hour of creative focus, but they trade it away for meetings with no agenda and emails they don’t remember sending. Worse, they act as if that trade was rational. They optimize their schedule for everyone but themselves.

This is the first inversion: treat time not as a default resource but as a scarce luxury. The economist in you knows scarcity creates value. The stoic in you knows value must be defended.

So defend it.

Time Arbitrage and the Quiet Rich

In finance, arbitrage is the practice of exploiting market inefficiencies for profit. In life, time arbitrage is doing the same thing with attention. It’s what lets a junior engineer earn $120k while only working 20 actual hours a week because their manager is too disorganized to notice. It's what lets a newsletter writer build a $2M business on two days of effort per week. And it’s what lets a small-town carpenter be rich in sunsets, unhurried breakfasts, and Tuesday mornings at the lake.

You don’t have to move to Bali or quit capitalism. You just have to understand which parts of the attention economy are underpriced, and which parts are scams. Consider the low-arbitrage environments: endless Slack threads, reactive email inboxes, dopamine-heavy social feeds. Then look at the high-arbitrage ones: focused creation, asynchronous systems, long-term thinking, low-input leverage.

The classic case study is Tim Ferriss’s 4-Hour Workweek, but that book was never about idleness. It was about systems that convert time into assets, not just outputs. Every automated SOP, every VA-managed task, every delegated decision: time arbitrage. Every new decision you don’t have to make tomorrow: time arbitrage.

You don't need to become a monk or a dropshipper. But you do need to ask: where am I being tricked into paying full price for time that someone else got wholesale?

The Myth of Optimization

This is where the productivity cult goes wrong. It teaches you to optimize. It gives you color-coded calendars and 17-tabbed Notion setups and $400 courses on morning routines. But optimization is a poor strategy when the rules of the game are rigged.

You can’t out-optimize a system designed to fragment your focus. You can only exit it. Not in the "sell everything and move to a cabin" way. In the "choose your inputs like an investor" way. Seneca wrote, “People are frugal in guarding their personal property; but as soon as it comes to squandering time, they are most wasteful.” The modern version of this is a founder who won't spend $30 without checking ROI, but casually gives away three hours a day to reactive bullshit.

There is no productivity app that fixes that. There is only strategy.

And strategy means subtraction. Cut meetings. Cut status games. Cut the things that look like work but produce no leverage. Every minute you reclaim is a minute you own.

There’s a phrase Nassim Taleb uses: “via negativa.” It’s the act of removing rather than adding. This is the only kind of productivity that matters. Not how much more you can do, but how much less you can tolerate.

Time Billionaire Math

A time billionaire, as coined by Graham Duncan, is someone with a billion seconds left to live. That’s about 31 years. The catch is, you only get to spend them once.

So the math gets interesting. A tech exec makes $1 million a year but gives away 70 hours a week. A solo creator makes $200,000 but works 15 hours on their own terms. Who is richer?

We’re trained to think of wealth in absolute terms. But time wealth is always relative. Relative to obligations. Relative to autonomy. Relative to joy.

A teenager with no meetings and a summer ahead of them is wealthier than a CEO on a private jet sprinting to the next crisis.

You can start to see the contours of a different kind of status: one that isn't broadcast on LinkedIn, but hidden in the calendar. Blank space is the new Rolex.

Becoming Illiquid

If money is liquid wealth, time is illiquid. You can’t hold it, you can’t invest it, and once it’s gone, it doesn’t return. That makes it harder to value. People give it away precisely because they can’t see the cost.

The most dangerous commitments are the ones that seem small. A recurring 30-minute sync. A friendly favor. A weekend gig. Like compound interest in reverse, they silently consume your account. And because they don’t feel expensive, you never notice you’re getting poorer.

This is how time poverty begins: one small obligation at a time. By the time you look up, your day has no space. Your week is gone. Your year was spent earning money you didn’t need to buy time you didn’t get to use.

To become time rich, you have to become time illiquid. That means creating buffers. That means hoarding blank space. That means refusing to monetize every waking hour just because you can. It’s the discipline to hold time unspent.

Owning the Whole Stack

Time wealth isn’t working less. It’s controlling the stack: when you work, how you work, what you work on, who you answer to, and what you’re building toward.

It’s the builder who designs their week like an architect, not the employee who survives it like a commuter.

Control is the highest form of luxury. Autonomy is the ultimate dividend. In a world where every minute is for sale, freedom means being the only one who can name your price.

This does require infrastructure. Systems, routines, safeguards. But it also requires philosophy. A worldview that doesn’t treat busyness as virtue or productivity as identity.

You aren’t a machine with output metrics. You are a finite organism in a system that wants to harvest your time. Owning the stack means deciding where that time goes.

The Calendar as a Moral Document

The late theologian William Stringfellow believed a society’s use of time revealed its ethical compass. By that measure, the modern calendar is an indictment.

A culture that books every hour is a culture afraid of idleness. A person who fills every slot is a person who distrusts their own curiosity. We don’t just overschedule. We overcommit as a way to avoid the moral question: what would I do if no one was telling me what to do?

To become a time billionaire is not just to own your time. It’s to face that question honestly.

Do you have a self that exists outside obligations? Can you build a life around presence, not performance? Can you defend a blank calendar without apology?

These are not logistical questions. They are moral questions.

The Asset Class of Attention

If time is the currency, attention is the investment. And most people are making terrible bets.

They check 30 feeds. They juggle 6 conversations. They scroll to "relax" and end up more anxious. They live in an attention market flooded with junk bonds.

A time billionaire does something else. They concentrate. They focus. They protect the asset. Their attention is deployed like capital: carefully, intentionally, with an eye toward long-term return.

The irony is, it’s not even about being productive. It’s about being free. The freedom to follow a thought to its conclusion. The freedom to write something strange and true. The freedom to walk, think, sit, read, build, or simply be, without checking in with a thousand invisible bosses.

In that sense, the time billionaire isn’t merely wealthy. They are sovereign.

Exit Strategies

You don’t need to quit your job. But you do need to reclaim your hours. You don’t need to move to the woods. But you do need to stop letting the world schedule your life.

There is a game being played for your time. The platforms want your hours. The feed wants your focus. The culture wants your availability. And all of it comes with a price.

You get to decide if you want to pay it.

Becoming a time billionaire is not becoming rich later. It’s realizing how wealthy you already are. The account is full. The hours are yours.

Spend them like they matter.

Because they do.